July 12th, 2021

Global DMC Partners Shares Their Latest Findings from Q2 Meetings & Events Survey

-

As the industry gets back to in-person events, new challenges, primarily travel/flight restrictions, venue availability and staffing, are arising within this ramp-up phase.

-

Indicators point to meeting and event budgets beginning to increase. While only 12 percent of planner respondents reported budgets were increasing in Q1, that number has increased by 14 points with 26 percent of planners now reporting that their budgets are increasing.

-

Market demand is starting to shift and widen. Europe is gaining more traction for 2021 programs as compared to Q1 survey results, and planners are considering more regions across the globe for their 2022 programs.

Global DMC Partners (GDP), the world’s premier centralized resource for virtual, hybrid and in-person events, recently released the results of its Q2 Meetings & Events Pulse Survey during its quarterly webinar. Attracting nearly 250 online participants, the virtual event included a panel of industry experts weighing in on the top findings, discussing insights from their own perspectives and sharing their real-world best practices. Hosted and moderated by GDP President & CEO Catherine Chaulet, the timely and interactive discussion included a diverse range of voices and perspectives from across the globe and in various categories, including corporate meetings, associations and incentives. Panel participants included Helen Capelin with Ashfield Event Experiences, Becky Cavanaugh with Syneos Health, Danene Dustin with Morris Meetings & Incentives, Tom Edelen with Thrivent Financial, Megan Griggs with Intellectual Property Owners Association, Cindy Grove with Morley Meetings & Incentives, Katherine Kirk with Chicago Is…LLC, A Global DMC Partner, and Kuba Piotrowski with Oriflame. In addition to these industry experts, the webinar also included live audience polls on each of the following top challenges in returning to face-to-face meetings and events.

Travel Restrictions and Vaccines

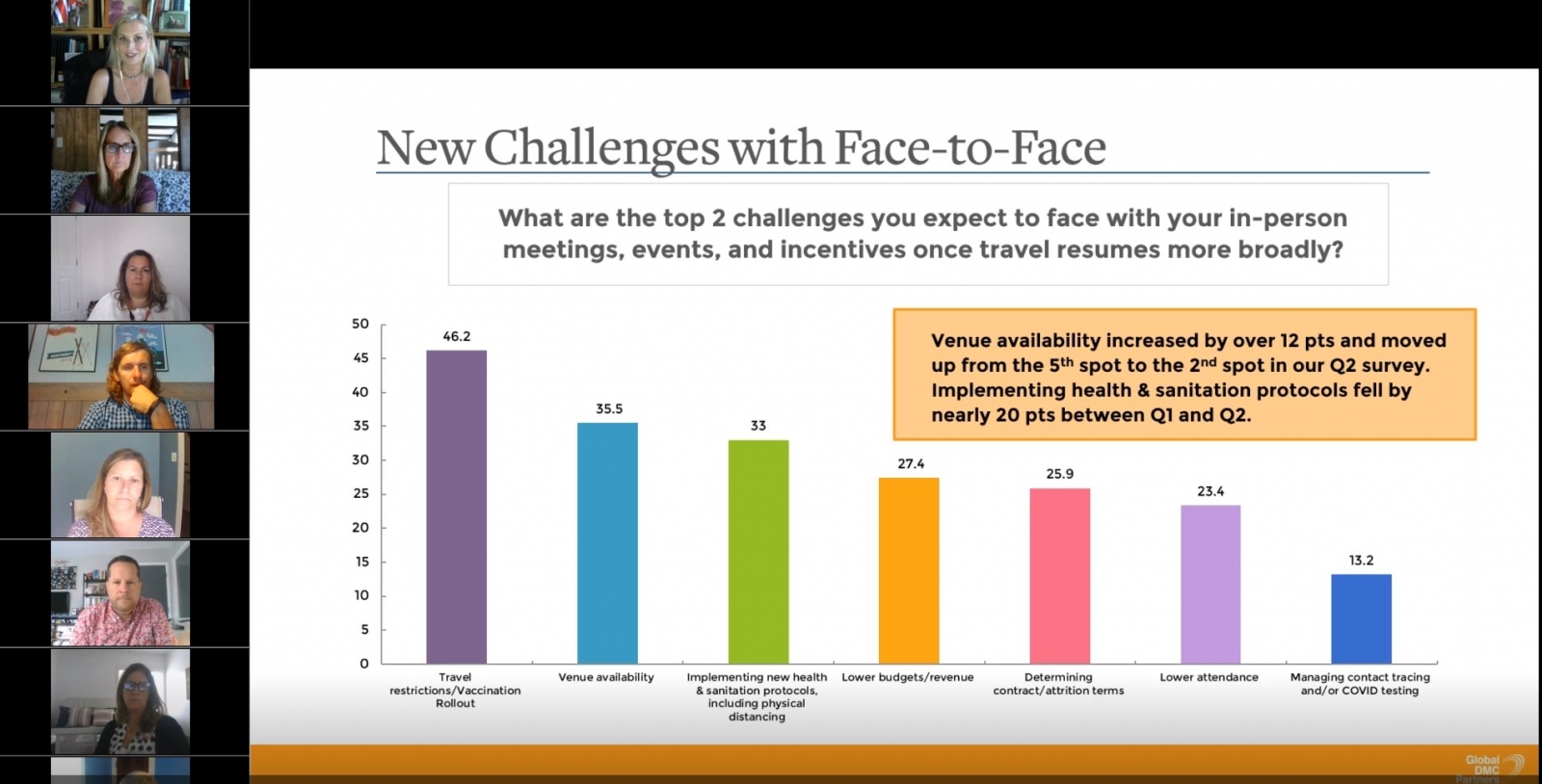

When asked in the Q2 survey, 46 percent of respondents cited travel restrictions and vaccine rollout as their primary challenges in returning to in-person events. Surprisingly, the challenge of implementing health and sanitation protocols dropped significantly, by nearly 20 points, in comparison to the Q1 survey results.

During the webinar’s live poll question on this topic, the audience reported that travel limitations and flight restrictions are their biggest concern in getting back to in-person meetings and events (45 percent).

Rising Costs, Established Budgets

The majority of survey respondents (32 percent) reported that program budgets have not changed significantly, which poses an additional challenge as hotel room rates, airfares and other associated costs are rising. However, indicators do show that budgets may be starting to increase on the whole. As compared to 12 percent in Q1 findings, 26 percent of planners are now reporting that their meeting and event budgets are increasing. Furthermore, 33 percent of planners reported budgets were decreasing in Q1, with only 23 percent reporting they are decreasing in Q2.

Venue Availability and Staffing Shortages

Webinar poll respondents also noted that staffing – both internal staffing and event onsite staffing – has lately become a greater challenge as demand continues to increase. This was also echoed by the panelists who pointed to issues that have surfaced with their event vendors – such as hotel, venue, décor, and A/V suppliers – being short-staffed. Vendor staffing shortages have led to slow response times, limited services and hours of operation, and onsite event management issues.

Based in the United Kingdom, panelist Helen Capelin with Ashfield Event Experiences stated that while demand is anticipated to reach pre-pandemic levels this fall, venue availability is currently her biggest concern. City center hotels are not a viable option at this time, so clients are looking for rural alternatives. Staffing in the U.K. is also an issue due to Brexit implications as Continental European workers are leaving the country. At the same time, many hospitality workers in the United Kingdom are also leaving the industry.

U.S. panelist Becky Cavanaugh with Syneos Health concurred. During a recent site inspection in Nashville, Tennessee, she found that most of the hotels and venues are fully booked. Room rates are particularly high; however, many hotels are still offering limited services. Some hotels have not brought back room service or daily housekeeping.

Chicago-based panelist Katherine Kirk with Chicago Is…LLC, A Global DMC Partner said that due to staffing limitations in her market, DMCs are playing an even more important role in pre-planning events, and having candid conversations in advance with venues and suppliers.

Cindy Grove with Morley Meetings & Incentives highlighted that many of her clients have specific dates and destinations in mind. However, due to limited venue availability, planners need to paint the picture of reality. Lead times for responses are slower because hotels and venues are not yet fully ramped up and hotel sales teams are overwhelmed with RFQs. Furthermore, hold time windows are now very short. Clients need to make swifter decisions than in the past as some hotels will not guarantee rates and space until the contract is executed.

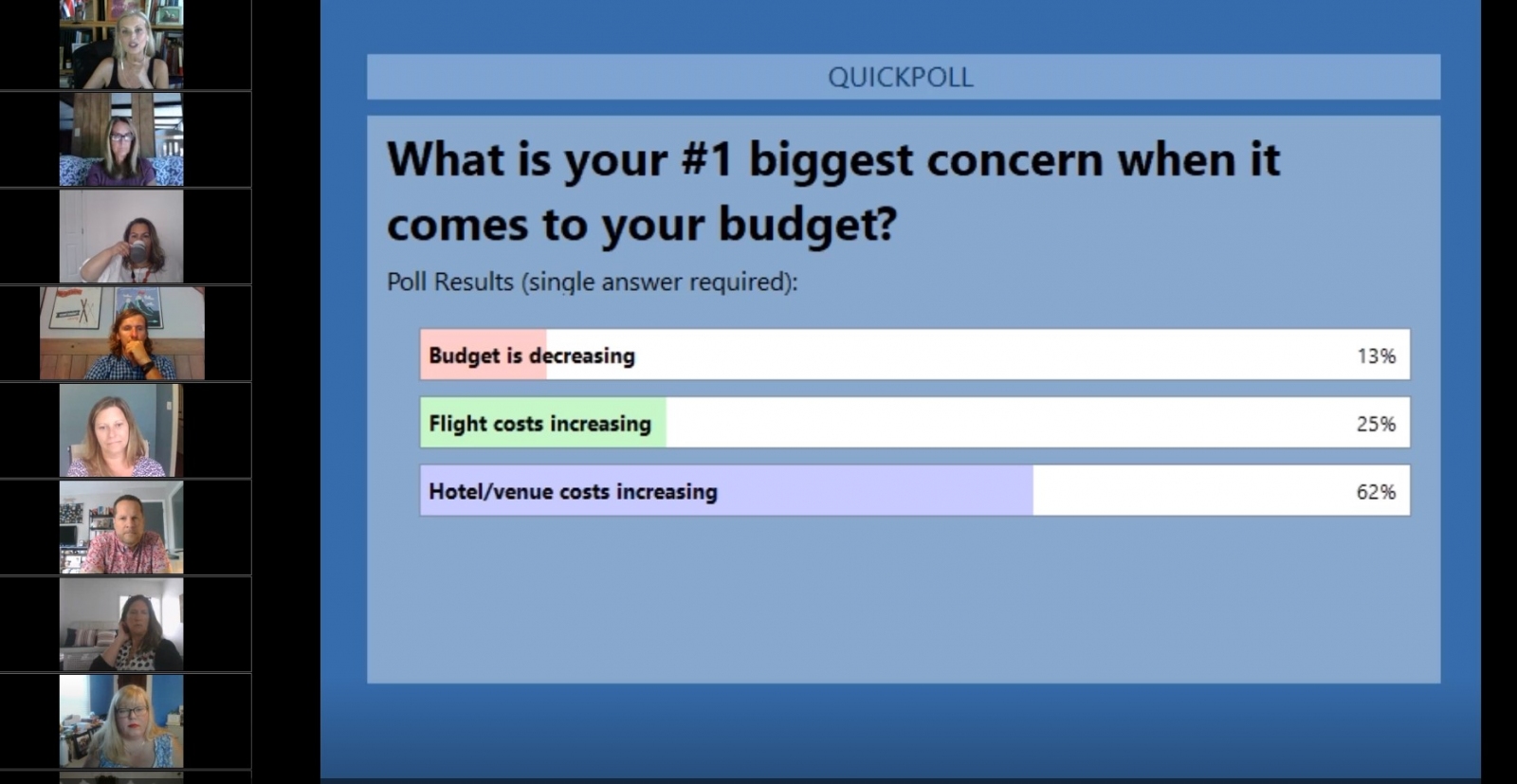

In a follow-up live poll question, 62 percent of webinar participants responded that hotel/venue costs are the biggest concerns regarding budget, followed by increasing flight costs (25 percent).

Virtual vs. In-person Events

Tom Edelen with Thrivent Financial shared that his company is still grounded at this time, and only essential travel is approved. However, they are hoping to get site inspection visits for 2022 programs underway soon. This coincides with Q2 results with 77 percent of planners indicating that their companies are allowing travel either now or by the end of 2021.

Kuba Piotrowski with Oriflame stated that all of their 2020 and 2021 programs have pivoted to virtual. However, they are returning to face-to-face programs in 2022 by dividing incentive programs into smaller, regional groups rather than large, global events. Piotrowski’s comment coincides with Q2 results around virtual events as 79 percent of respondents report that they are hosting virtual events in 2021. However, the majority of respondents (52 percent) report that they will not permanently hold programs virtually in the future.

From the associations perspective, Megan Griggs with Intellectual Property Owners Association is hopeful that in-person attendance for association programs in 2021 will reach 25 to 50 percent of total attendees. She also shared a new version of the hybrid model, holding two separate meetings: one in-person portion and a virtual piece the week following. Everything in the live event is recorded, rather than streamed, for the virtual sessions, and live attendees also receive additional virtual sessions. She predicts this could be a more stable, safer and cost-effective way of doing business.

Edelen agreed, saying that livestreams are too risky and costly. Instead, recordings can be available at a later time for attendees to view at their own convenience. He also recommended having a separate host specifically for online attendees so that they feel more connected and are more engaged.

Shifts in Market Demand

The webinar concluded with the important topic of market demand. From its global perspective in sourcing and vetting RFPs from across the world, Global DMC Partners reported that planners are considering more regions outside of their respective domestic markets for 2022 programs. The Q2 survey findings support this; in particular, Europe is gaining more traction as compared to the Q1 survey results. From the panel of experts, the top destinations of interest at this time are the U.S., Mexico, the Caribbean and parts of Continental Europe.