February 7th, 2023

Global DMC Partners Releases Results and Key Findings of Q4 2022 Meetings & Events Survey

Insights include higher costs as the top challenge for planners, a positive outlook for attendance levels at in-person events and the growing importance of sustainability

Global DMC Partners (GDP), the largest global network of independent Destination Management Companies (DMCs) and specialized event service providers, has released the results of its Q4 Meetings & Events Pulse Survey, a report on what is currently driving decisions in the global meetings and events industry. With responses collected from November 10 through December 16, 2022, the report covers topics including current challenges, the importance of sustainability, in-person event attendance, hiring trends and more. The survey polled 200 meeting and event professionals, the majority of whom are U.S.-based, with 26 percent in Europe. Respondents were corporate/direct planners (48 percent), followed closely by third-party planners (43 percent) and a small percentage of association planners (nine percent).

Highlights from the responses included:

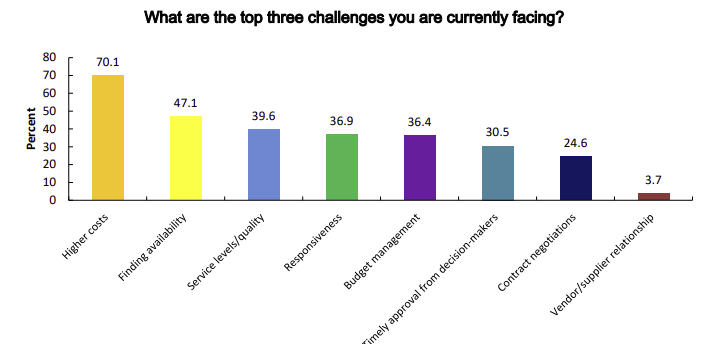

- Both budgets and costs are increasing, and high costs is the top challenge for planners as they are pushed to deliver extraordinary events within tight budgets.

- Finding availability and service levels/quality are the number two and three top challenges for planners

- Attendee numbers at in-person events are approaching pre-pandemic levels.

- The importance of sustainability grew throughout 2022, especially for companies outside the U.S.

- Many companies are still actively hiring with an increased number of planners reporting they are hiring freelance/event staff.

Higher Costs Remain the Number One Challenge

Eighty-eight percent of respondents report that budgets have increased due to inflation/higher costs, and this percentage has increased from 68 percent in Q2 2022. Planners continue to be tasked to do more with less and to educate their clients that there is less room to negotiate in the current economic climate. Rising airfare costs are still affecting the chosen destinations for the majority of planners (68 percent), with 60 percent reporting the same in Q2 2022. Some cited in the comments that their organizations or clients are choosing locations based on where the majority of their attendees are located, and/or locations that have other transportation methods for attendees, for example trains.

On the other hand, budgets are also increasing. Forty-seven percent of planners say their budgets for meetings increased over the course of 2022, with 35 percent reporting their incentive budgets increased. More planners (55 percent) are now reporting that 2023 and 2024 budgets are increasing as compared to what they reported in May 2022 on the Q2 survey. Nearly 15 to 17 percent more planners report their budgets are increasing for 2023 as compared what they reported in Q2 2022. On average, 10 percent more planners now report that their budgets are increasing for 2024 as compared to what they reported in Q2 2022.

“Our clients provided valuable insight into the issue of increasing costs in relation to their budgets,” said Global DMC Partners President and CEO Catherine Chaulet. “Some survey respondents commented that they are being asked to find savings in order to deliver the best solution for the same budget, while others mentioned that they are now tasked with making budgets that were set over a year ago work in the current climate. Thanks to our far-reaching global network with boots-on-the-ground in nearly every destination, our team is able to help clients alleviate some of these current challenges.”

According to the report, most organizations (47 percent) are increasing their pricing for services or events, similar to feedback from Q2; however, more international planners (50 percent) are reporting that their organizations are increasing pricing for services or events as compared to only 27 percent reporting the same in Q2 2022. The top reason for increasing prices is to match higher operating costs.

Other Top Challenges: Finding Availability and Service Levels/Quality

With prolonged industry staffing challenges and high demand for in-person events, these two challenges are high on the list, with responsiveness and budget management falling close behind.

Top Concern When Negotiating a Contract: Cancellations and Rebooking

For 48 percent of survey participants, the top concern when negotiating a contract is cancellations and/or rebooking terms. In a post-pandemic world, hotels are requesting larger first deposits, with very strict cancellation terms. Some respondents report that if a hotel cancels on the group, they want to follow the same cancellation tiers as if the group would cancel with the hotel, making it difficult to accept the contract.

Positive Outlook for Attendance Levels at In-Person Events

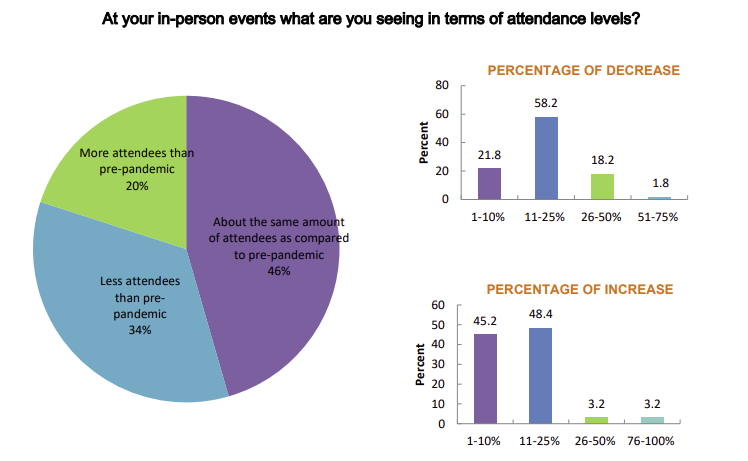

Sixty-six percent of planners report that their attendance levels at in-person events are the same now as they were pre-pandemic, or greater than what they were pre-pandemic. Some respondents noted that they see more last-minute event attendees and that delegates are not signing up far in advance.

More than half of the respondents (53 percent) reported that their organizations are not hosting virtual events in 2023 and beyond. Forty-one percent reported that less than 10 percent of their events will be virtual. Some planners are incorporating hybrid elements for budget and eco-friendly reasons.

The Importance of Sustainability Continued to Grow Throughout 2022

Overall, the international response to incorporating sustainability into travel, meetings and events is more positive than their U.S./Canadian counterparts, and this disparity has grown over the course of 2022, especially when it comes to requiring that suppliers have a certification of sustainability. Fifteen percent more of overall respondents now report that they or their clients have sustainability goals in place for their programs as compared to the Q2 2022 report. This sentiment has grown substantially within the international pool of respondents with 73 percent reporting they or their clients now have sustainability goals in place as compared to only 45 percent in Q2 2022.

Regions of Interest

The top five regions for programs in 2022 by U.S. and Canadian respondents were the United States/Canada, Europe and the U.K. and Mexico, Caribbean and Central America. For international respondents, the top five regions for programs in 2022 were Europe and the U.K., United States/Canada, the Middle East, Asia and Mexico. For 2023 programs, there is increased interest in almost all regions around the globe, with particular increases in Europe and the U.K., Asia, South America, the Middle East, Africa and Australia and the South Pacific.

Many Planner Organizations Report Ongoing Hiring

Slightly less respondents are reporting that their companies are hiring as compared to earlier on in 2022, although 45 percent report that they are actively hiring or will be hiring later this year. Mid-level and entry-level positions are still the most popular level roles to be hiring for, and more planners (32 percent) are now reporting that they are hiring for freelancers/event staff as compared to 23 percent in Q2 2022. Twelve percent more planners are now reporting that their companies have had to increase salaries/compensation packages to attract the right candidates.